Wells Fargo Org Chart & Sales Intelligence Blog

Wells Fargo & Company

420 Montgomery Street

San Francisco, CA 94104

United States

Main Phone: 866 249 3302

Website: https://www.wellsfargo.com

Ticker Symbol: (NYSE: WFC)

Industry Sector: Financial Services - Banks, Diversified

Full Time Employees: 246,577

Facebook: https://www.facebook.com/wellsfargo/

LinkedIn: https://www.linkedin.com/company/wellsfargo/

Twitter: https://twitter.com/wellsfargo/

Instagram: https://www.instagram.com/wellsfargo/

YouTube: https://www.youtube.com/user/wellsfargo

Wells Fargo Fortune 500 Rank: #37

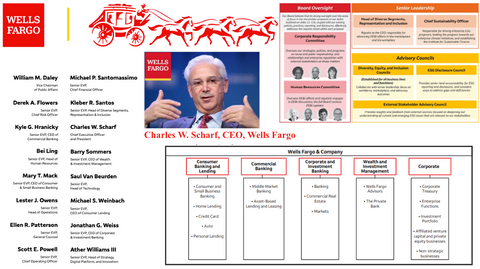

What is Wells Fargo's Corporate Structure?

PREVIEW

Download the Wells Fargo Org Chart & Sales Intelligence Report see the full 11 organizational charts.

WHO are the key decision makers at Wells Fargo?

| NAME | TITLE |

| Charles W. Scharf | Chief Executive Officer and President |

| William M. Daley | Vice Chairman of Public Affairs |

| Kyle G. Hranicky | Senior EVP, CEO of Commercial Banking |

| Mary T. Mack | Senior EVP, CEO of Consumer & Small Business Banking |

| Barry Sommers | Senior EVP, CEO of Wealth & Investment Management |

| Michael S. Weinbach | Senior EVP, CEO of Consumer Lending |

| Jonathan G. Weiss | Senior EVP, CEO of Corporate & Investment Banking |

| Scott E. Powell | Senior EVP, Chief Operating Officer |

| Michael P. Santomassimo | Senior EVP, Chief Financial Officer |

| Derek A. Flowers | Senior EVP, Chief Risk Officer |

| Lester J. Owens | Senior EVP, Head of Operations |

| Saul Van Beurden | Senior EVP, Head of Technology |

| Bei Ling | Senior EVP, Head of Human Resources |

| Kleber R. Santos | Senior EVP, Head of Diverse Segments, Representation & Inclusion |

| Ather Williams III | Senior EVP, Head of Strategy, Digital Platform, & Innovation |

| Ellen R. Patterson | Senior EVP, General Counsel |

| Paul Ricci | EVP, Interim Chief Auditor |

| Muneera S. Carr | EVP, Chief Accounting Officer, and Controller |

Download the Wells Fargo Org Chart & Sales Intelligence Report to gain access to profiles of the key decision-makers at Wells Fargo.

WHO serves on Wells Fargo's Board of Directors?

| NAME | TITLE | COMPANY |

| Steven D. Black | Chairman | Wells Fargo |

| Charles W. Scharf | Chief Executive Officer and President | Wells Fargo |

| Mark A. Chancy | Retired Vice Chairman and Co-Chief Operating Officer | SunTrust Banks, Inc. |

| Celeste A. Clark | Principal | Abraham Clark Consulting, LLC |

| Theodore F. Craver, Jr. | Retired Chairman, President and CEO | Edison International |

| Wayne M. Hewett | Senior Advisor, Permira, and Chairman | DiversiTech Corporation |

| Maria R. Morris | Retired EVP and Head of Global Employee Benefits | MetLife, Inc. |

| Richard B. Payne, Jr. | Retired Vice Chairman, Wholesale Banking | U.S. Bancorp |

| Juan A. Pujadas | Retired Principal | PricewaterhouseCoopers LLP |

| Ronald L. Sargent | Retired Chairman and CEO | Staples, Inc. |

| Suzanne M. Vautrinot | President | Kilovolt Consulting, Inc. |

Where is Wells Fargo investing in their business operations?

PREVIEW

Wells Fargo says the company will save $1 Billion over the next 10 years by Migrating to the Public Cloud, according to CIO

Apr 2022

Amid Wells Fargo's new "digital infrastructure strategy", the company is planning to retire much of its on-premise tech stack and kick off a multi-cloud migration. Wells Fargo's chief information officer, Chintan Mehta and head of digital technology & innovation, said that while the efforts will involve "heavy capital outlay," time savings is the target.

Mehta's team is responsible for re-architecting a key data platform that the bank uses to personalize online customer experiences and anticipate customer needs. Putting the so-called customer experience engine on the public cloud will allow the bank to scale the platform and perform "billions" of calculations a day while still protecting data, Mehta said.

"Money is one part of it, but then the amount of time you end up expending and building out an infrastructure before something productive happens on it shrinks significantly when you have something like cloud," he said.

Fortune 500 Bank Wells Fargo Announces Enhancements to Fraud Protection and Customer Experience Using FICO Solutions

Mar 2022

Wells Fargo was recently honored as FICO’s Choice 2022 Industry Vanguard Award recipient due to its success in utilizing FICO analytic software solutions to protect its consumer and business accounts. The company incorporated FICO® Falcon® Fraud Manager and applied machine learning analytics to internal third data to identify fraud attacks. The use of FICO was apart of the company's new strategy to enhance customer experience

Wells Fargo was recently honored as FICO’s Choice 2022 Industry Vanguard Award recipient due to its success in utilizing FICO analytic software solutions to protect its consumer and business accounts. The company incorporated FICO® Falcon® Fraud Manager and applied machine learning analytics to internal third data to identify fraud attacks. The use of FICO was apart of the company's new strategy to enhance customer experience

“As a company, we’re focused on highly effective fraud prevention measures that adapt to constantly changing threats with minimal disruption to the customer experience,” said Matt Powell, head of Fraud and Claims Management for Consumer and Small Business Banking Operations at Wells Fargo.

Wells Fargo's Head of Strategy, Digital Platform and Innovation Discusses the company's 2022 strategic pillars

Feb 2022

Ather Williams III serves as SEVP and Head of Strategy, Digital Platforms, and Innovation at Wells Fargo. He is responsible for managing digital platforms / capabilities and corporate strategic planning. Additionally, he oversees innovation priorities for the company's ongoing transformation.

Ather Williams III serves as SEVP and Head of Strategy, Digital Platforms, and Innovation at Wells Fargo. He is responsible for managing digital platforms / capabilities and corporate strategic planning. Additionally, he oversees innovation priorities for the company's ongoing transformation.“We work across those businesses, across all of our range of capabilities, covering our 69 million customers, and all of our functions to put together a coherent strategy to serve those clients in an innovative way,” noted Williams.

Williams is currently focused on one of the key strategic pillars that his team has defined which is, helping to drive focuses on technology and innovation and having a digital-first mindset. “Digital platforms are a natural place to sit with me because it is a transformation of how we bring together a consistent consumer experience that starts with mobile across our deposits and payments business, our consumer lending business and our wealth management business,” said Williams. “[This intersection] will easily migrate across our other channels, be it an ATM, a branch or a financial advisor's office.”

Wells Fargo has Announced New Strategic Partnerships and Digital Infrastructure Strategy With Google Cloud and Microsoft

Sept 2021

“Launching our new digital infrastructure strategy is a critical step in our multiyear journey to transform Wells Fargo, making it easier for customers to do business with us and creating a better working experience for our employees,” said Saul Van Beurden, Wells Fargo’s head of Technology. “The Wells Fargo of tomorrow will be digital-first and offer easier-to-use products and services, and all of that starts with driving speed, scalability, and enhanced user experience through the next generation digital infrastructure strategy we’re announcing today.”

Download the Wells Fargo Org Chart & Sales Intelligence Report to gain access to all 33 sales trigger events.

What are Wells Fargo's Executive Leaders saying about business performance?

PREVIEW

Wells Fargo & Company Q1 2022 Earnings Conference Call

April 14, 2022

Executives in Attendance:

- John Campbell - Director, IR

- Charlie Scharf - CEO

- Mike Santomassimo - CFO

Analysts Present:

- Scott Siefers - Piper Sandler

- Steven Chubak - Wolfe Research

- John Pancari - Evercore ISI

- Ken Usdin - Jefferies

- John McDonald - Autonomous Research

- Ebrahim Poonawala - Bank of America

- Betsy Graseck - Morgan Stanley

- Matt O’Connor - Deutsche Bank

- Erika Najarian - UBS

- Charles Peabody - Portales Partner

- Gerard Cassidy - RBC Capital Market

- Erika Najarian - UBS

Comments from Charlie Scharf - CEO:

“Now, let me update you on progress we’ve made on our strategic priorities. Building an appropriate risk and control infrastructure remains our top priority, and I continue to believe that we’re making significant progress."

"Early in the first quarter, we named Derek Flowers, our new Chief Risk Officer, following Mandy Norton’s retirement announcement. Derek has extensive experience managing risk including the work he’s done over the last several years of managing the build-out of Wells Fargo’s risk and control framework."

"We added approximately 500,000 new mobile active customers in the first quarter alone. We continue to invest to improve our digital capabilities with additional enhancements planned for this year. We’re also focused on reducing friction and moving money. We’ve continued to invest in Zelle and made changes to expand customer usage, including increasing sending limits. These changes have helped to drive 21% growth in active send customers and a 33% increase in send volume from a year ago."

"We continued to enhance our credit card offerings with our partnership with Bilt Rewards and MasterCard. This first of its kind co-brand card allows members to pay rent and earn points with no transaction fees on rent payments at any apartment in the U.S."

"In the first quarter, we selected nCino to streamline our origination, underwriting and portfolio management for our small business customers. This collaboration is expected to provide our customers with a more streamlined lending experience and builds on our existing relationship that we announced last year to accelerate our digital transformation within our Commercial Banking and corporate investment banking businesses."

Download the Wells Fargo Org Chart & Sales Intelligence Report to gain access to full Wells Fargo investor presentations and earnings call highlights.

How is Wells Fargo performing financially?

| Fiscal Year | |

| Fiscal Year Ends | December 31, 2022 |

| Most Recent Quarter | April 14, 2022 |

| Profitability | |

| Profit Margin | 25.18% |

| Operating Margin | 34.29% |

| Management Effectiveness | |

| Return on Assets | 1.15% |

| Return on Equity | 12.08% |

| Income Statement | |

| Revenue | $81.75 Billion |

| Revenue Per Share | 20.52 |

| Quarterly Revenue Growth | -6.10% |

| Gross Profit | 82.95B |

| Net Income Avi to Common | 19.39B |

| Diluted EPS | 4.83 |

| Quarterly Earnings Growth | -20.80% |

| Balance Sheet | |

| Total Cash | 383.7B |

| Total Cash Per Share | 101.24 |

| Total Debt | 202.44B |

| Book Value Per Share | 42.17 |

Download the Wells Fargo Org Chart & Sales Intelligence Report to see full financial presentations.

What roles at Wells Fargo are undertaking the new digital infrastructure strategy?

PREVIEW

Senior Software Engineer

Charlotte, NC

The Digital Technology and Innovation group supports the Corporate Strategy, Digital Platform & Innovation Business. The Senior Software Engineer works within this group.

The Senior Software Engineer is responsible for leading initiatives and deliverables within technical domain environments. Contributes to large scale planning of strategies Design, code, test, debug, and document for projects and programs associated with technology domain, including upgrades and deployments. Reviews moderately complex technical challenges that require an in-depth evaluation of technologies and procedures. Resolves moderately complex issues and lead a team to meet existing client needs or potential new clients needs. Works with developers on a daily basis to design solutions around continuous integration and continuous delivery.

Technologies in Use: Linux OS, ANT, Maven, Splunk, Python, JIRA, AppDynamics, Jenkins Continuous Integration

Head of Fraud Management Technology

Charlotte, NC; San Francisco, CA; Des Moines, IA; Tempe, AZ; Minneapolis, MN; New York, NY

The Head of Fraud Management Technology is tasked with enabling proactive detection, prevention and mitigation of Fraud leveraging innovative technologies and the 24x7 Fraud Ops Center. Leads the development and implementation of technology enabled fraud strategies across functions and products across the bank, including Deposit Fraud Strategy, Lending Fraud Strategy and Digital Fraud Strategy. Drives innovative technology in partnership with the Cyber Security Team, to manage fraud risk and minimize losses through monitoring, reporting and taking appropriate action, ensuring compliance requirements, audits and verifications are completed in accordance with regulatory requirements and bank policies.

Technologies in Use: Java/C++, R, Python, AI/ML, API, FICO Blaze Advisor, FICO Falcon Fraud Manager, Java, Angular, JQuery, HTML, JavaScript, Node JS, React JS, NO SQL, Hadoop

Download the Wells Fargo Org Chart & Sales Intelligence Report to see all 21 job descriptions.

More on Wells Fargo

- Wells Fargo Contact Information

- Wells Fargo Org Charts on Corporate Structure, Executive Leadership, Sales, Marketing, Finance, HR, Supply Chain, Technology. R&D, Manufacturing, etc.

- Wells Fargo Financial Insights

- Wells Fargo SWOT Report

- Wells Fargo Technologies in Use

- Wells Fargo IT Budgets

- Wells Fargo Social Media Profiles

- Wells Fargo Actionable Sales Trigger Events

About databahn

databahn builds customized deep dive account intelligence reports to help sellers and marketers eliminate costly research time and build pipeline opportunities. databahn focuses on large and complex Fortune 500, Fortune 1000, Global 2000, State Government, and Higher Education organizations. databahn's highly experienced research team is located in beautiful Nashua, New Hampshire. For more information, please email info@databahn.com