Michael Fiddelke Succeeds Brian Cornell as Target CEO — Implications for the Future

Target Corporation

NYSE: TGT

1000 Nicollet Mall

Minneapolis, MN 55403

United States

Main Phone: (612) 304-6073

Website: https://target.com

Industry sector: Consumer Packaged Goods - Discount Stores

Full Time Employees: 440,000

Fiscal Year End: February 1

Annual Revenues: $105.64 Billion USD

CEO: Brian Cornell (current) - Michael Fiddelke (Feb 1, 2026)

Fortune 500 Rank: #41 in 2025

Who is Michael Fiddelke, and what is his background?

Michael Fiddelke is the newly appointed Chief Executive Officer (CEO) of Target Corporation, officially taking the reins on February 1, 2026. Having started his Target journey as an intern in 2003, Fiddelke's career at the retailer is a consummate example of upward mobility and diverse experience. Over more than two decades, he’s held critical leadership positions across finance, merchandising, human resources, store operations, and supply chain management. Notably, he served as both Chief Financial Officer and Chief Operating Officer, where he guided Target’s nearly 2,000-store footprint, global supply chain, and fulfillment services such as Shipt.

Fiddelke is renowned for his operational acumen and modern approach to driving growth, with a proven track record of overseeing major investments in digital transformation, supply chain productivity, and enterprise efficiency. His background also includes a stint at Deloitte Consulting LLP, an MBA from Northwestern University’s Kellogg School of Management, and a degree in industrial engineering from the University of Iowa.

Why was Michael Fiddelke selected to succeed as CEO?

Target’s board of directors executed a deliberate and extensive succession plan, evaluating “a strong list of both external and internal candidates,” according to outgoing CEO Brian Cornell. Fiddelke emerged as the ideal leader to tackle both the company's strategic reset and its ongoing need for operational discipline.

Databahn's Target Corp Org Chart for the Board of Directors

Several factors influenced his selection:

Institutional Knowledge: With over 22 years at Target, Fiddelke’s deep organizational insight positions him to lead seamlessly without an onboarding lag.

Track Record of Execution: He spearheaded efforts that built Target’s resiliency during turbulent periods and accelerated investment in digital and supply chain capabilities.

Leadership through Transformation: Fiddelke has a history of leveraging technology and efficiency initiatives to create exponential growth and is known for aligning execution with Target’s core values and guest experience.

Why did this succession happen, and what's the context of the timing?

Brian Cornell decided to step down after 11 years, citing the desire to recharge and transition while supporting a new generation of leadership. He takes on the role of executive chairman, facilitating a smooth handover and continuity. The board’s move is proactive, reflecting both natural leadership succession planning and external business pressures.

The timing also aligns with Target’s urgent need for a turnaround. After periods of strong growth during the pandemic, Target began facing sales stagnation, increased competition, supply chain headwinds, and backlash from recent brand and strategic missteps, particularly around its approach to diversity, equity, and inclusion (DEI).

What was happening at Target that prompted this change?

By 2025, Target encountered multiple challenges:

Sales Declines: Target experienced several consecutive quarters of slowing or negative sales growth, a stark contrast to its earlier pandemic gains.

Brand & Strategic Uncertainty: The company struggled with consumer perception, product differentiation, and backlash from strategic pivots—especially from its retreat from DEI initiatives. These issues led to diminished brand enthusiasm and customer loyalty, eroding its “Tarzhay” image.

Competitive Pressure: Intensifying competition from Walmart, Amazon, and Costco forced Target to seek new ways to provide differentiated value and a compelling customer experience.

Investor Concerns: Wall Street became anxious about stagnant results, evidenced by a significant 10% stock slide after Fiddelke’s appointment was announced. There was debate over whether an internal appointment could break entrenched mindsets and bring the external perspective many believe Target needs.

How might Fiddelke’s appointment alter the trajectory of the business?

Fiddelke’s ascension signals both renewed discipline and targeted innovation rather than a radical overhaul. His tenure is expected to focus on:

Reestablishing Growth: Fiddelke has publicly prioritized restoring Target’s reputation for stylish and distinctive products, consistent guest experiences, and enhanced value.

Operational Efficiency: Building on his efficiency initiatives, further digital capability deployment, AI integration, and store innovation are likely, especially to modernize supply chain and inventory systems.

Brand Reinvention: Expect continued emphasis on blending physical and digital shopping (“phygital”), reimagining core categories, and updating owned brands and partnerships to reignite excitement.

Sustainable Transformation: Rather than quick fixes, Fiddelke plans a “longer-term effort… serving us for years to come,” notably via the Enterprise Acceleration Office and collaborative leadership.

What organizational changes might ensue under Fiddelke?

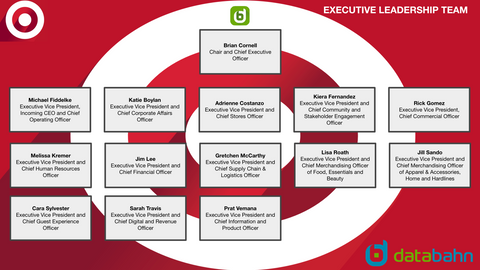

Databahn's Target Corp Org Chart on the Executive Leadership Team

Given Fiddelke’s strategic mindset, several changes are anticipated:

Cultural Reset: Expect a renewed focus on nimbleness, innovation, and transparent leadership. With previous criticism of “inward-focused groupthink,” there may be talent shifts or reshuffling to infuse new perspectives.

Investment in People & Tech: Staff training, morale initiatives, and next-generation technology investments (AI, same-day fulfillment, omni-channel integration) will take precedence.

Category Revamps: Multi-year initiatives will revitalize high-growth product categories (e.g., gaming, beauty, home, food collaborations), speed up product refresh cycles, and deepen brand partnerships.

Physical & Digital Expansion: The plan includes new store openings, strategic remodels, and continued expansion of same-day and drive-up services.

Is this a good thing for investors?

The market’s immediate reaction has been cautious, even negative, as evidenced by a notable stock drop after the announcement. Reasons for skepticism stem from:

Internal Promotion Concerns: Analysts hoped for an external disruptor to address Target’s strategic drift and inject fresh thinking.

Execution Risk: The degree to which Fiddelke can pivot Target’s culture and restore momentum, amidst fierce competition, is uncertain. If internal dynamics remain static, growth could remain elusive.

Strategic Opportunity: However, Fiddelke’s deep knowledge could enable swift, well-informed decisions and the continuity needed during complex times. His focus on supply chain modernization and digital initiatives, if successful, could unlock new profitability and market share opportunities for long-term investors.

How can a technology sales representative take advantage of this leadership change?

For tech sales reps, leadership transitions—especially at the COO-CEO level—are powerful sales trigger events. This is especially true at a Fortune 500 retailer like Target, undergoing digital and operational transformation. Here’s how sales professionals can capitalize:

Pitch Efficiency and AI Solutions: Fiddelke is known for prioritizing enterprise efficiency, automation, and technology-fueled growth. Pitch platforms that align with his history of supply chain, AI, and omnichannel innovation.

Leverage Org Change: Leadership succession typically brings organizational restructuring and updated buying priorities. Use this window to develop relationships with new decision-makers and position your technology as part of Target’s transformation playbook.

Tailor Outreach: Reference Fiddelke’s stated goals—restoring consistent guest experience, accelerating digital engagement, and driving operational excellence—in your value proposition.

Access Intelligence Tools: With so much flux, access to accurate, real-time org charts and sales intelligence is more critical than ever.

Ready to engage with Target’s new leadership and capitalize on pivotal changes?

Download the Databahn Target Corp Org Chart & Sales Intelligence Report for actionable insights, up-to-date executive contact data, and a complete playbook for technology sellers. Visit www.databahn.com for your deep-dive report and make sure you never miss a buying signal!