Hershey's Org Chart & Sales Intelligence blog

Hershey's Org Chart & Sales Intelligence blog

October 24, 2023

Hershey blog highlights:

- The Hershey Company is ranked #380 on the 2023 Fortune 500 list

- Hershey's 4 strategic imperatives include 1) scaling their salty snacks business 2) expanding internationally (M&A) 3) gain competitive advantage through differentiated capabilities and 4) focus on long term sustainability of the business

- Hershey's is spending $800M to $900 Million on CapEx. $300M to $400M on Technology Infrastructure including a major SAP ERP upgrade.

- They are constructing a new plant in Mexico. Now there are 3 plants in Mexico including Mexico City, Monterrey and Guadalajara.

- Hershey's hired their first ever Chief Technology Officer in September 2023. He's joining Hershey from Amazon.

- They're investing millions in advanced manufacturing and supply chain capabilities and technologies.

Scroll through the Hershey's Google Slides presentation here...

Please send us an email if you're experiencing any issues viewing the Google Slides presentation and we'll send you the PDF version. info@databahn.com

What are Hershey's Strategic Imperatives?

Hershey's vision is to be a snacking powerhouse.

Hershey is currently the number two snacking manufacturer in the United States.

They aspire to be a leader in meeting consumers’ evolving snacking needs while strengthening the capabilities that drive their growth.

They are focused on four strategic imperatives to ensure Hershey's success now and in the future:

- Drive core confection business and build and scale their salty snacks business

- Deliver profitable international growth

- Expand competitive advantage through differentiated capabilities

- Responsibly manage their operations to ensure the long-term sustainability of their business, the planet and their employees.

Hershey's strategic plan, and the financial metrics they establish to help achieve and measure success against their plan, serve as the foundation of their executive compensation program.

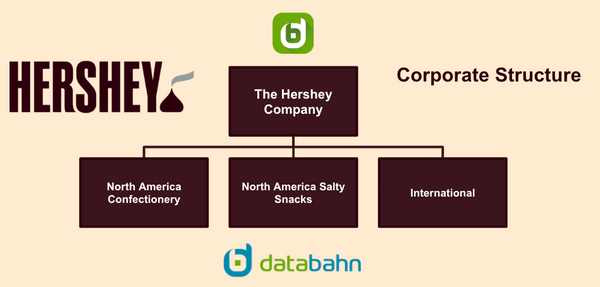

What does the Hershey Corporate Structure look like?

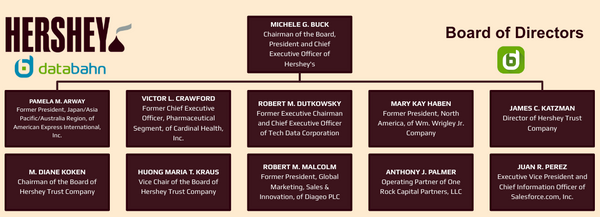

Who sits on the Hershey Board of Directors?

Who is on the Executive Leadership Team at Hershey?

What is the SWOT Analysis for Hershey's?

|

Strengths • Strong brand recognition and loyalty • Wide range of popular products • Global presence • Strong financial performance • Commitment to sustainability and social responsibility |

Opportunities • Expanding into new markets, such as Asia and Latin America • Developing new products that meet changing consumer preferences • Acquiring smaller, innovative confectionery companies • Partnering with other companies to cross-promote products |

|

Weaknesses • Reliance on the US market for a majority of revenue • Limited product innovation in recent years • Supply chain vulnerabilities • Competition from other major confectionery companies |

Threats • Changes in consumer tastes and preferences • Economic downturns • Increasing competition from private label brands • New government regulations on the food and beverage industry |

What is the PESTLE Analysis for Hershey's?

|

Political • Hershey is subject to a variety of government regulations, including those related to food safety, environmental protection, and labor practices. • The company's operations in other countries are also subject to local laws and regulations. Political instability in certain countries could disrupt Hershey's supply chain or operations. |

Technological • New technologies could help Hershey to improve its efficiency, product quality, and marketing efforts. For example, the company is using artificial intelligence to develop new products and improve its manufacturing processes. • However, new technologies could also create new challenges for Hershey, such as the rise of e-commerce and the threat of counterfeit products. |

|

Economic • Hershey's performance is affected by economic conditions, such as consumer spending and the prices of raw materials. • A recession could lead to a decline in consumer spending on discretionary items like chocolate. Currency fluctuations could also impact Hershey's profitability. |

Legal • Hershey is subject to a variety of laws and regulations, including those related to antitrust, intellectual property, and product liability. • The company must also comply with the laws and regulations of the countries in which it operates. New laws and regulations, such as those related to food labeling or data privacy, could impact Hershey's business. |

|

Social • Changing consumer tastes and preferences could impact Hershey's business. For example, consumers are increasingly demanding healthier and more sustainable products. • Hershey is also facing increasing pressure to address social issues, such as child labor and deforestation in its supply chain. |

Environmental • Hershey is committed to reducing its environmental impact. The company has set goals to reduce its greenhouse gas emissions, water consumption, and waste production. However, Hershey is also facing challenges such as climate change and water scarcity. • These challenges could impact the company's supply chain and operations. |

Hershey's Org Charts

Inside Hershey’s $1B push to boost its supply chain capacity

Aug 2023

Hershey plans to spend $1 billion to strengthen its supply chain for the long term, but don’t call its operations a cost center. The confectionery and salty snacks giant views its supply chain as a growth enabler rather than an expense to manage, SVP and Chief Supply Chain Officer Jason Reiman told Supply Chain Dive in an interview earlier this month. “We enable growth by the availability of our product, consistency and the delivery of high quality, and then also making sure that we bring capabilities that fit the unique needs of our customers and our customers,” Reiman said. The company’s multi-year supply chain investment is focused on adding production capacity. It’s going toward a new chocolate factory in Hershey, Pennsylvania, 13 new production lines and upgrading 11 existing lines. Core brands are the focus, with 60% of its investment addressing Reese’s alone. The undertaking will help Hershey maintain the supply chain “sweet spot” it’s found, according to Reiman. That means being nimble enough to react to demand growth while also having enough capacity to meet customers’ existing needs. “We’re in a much better spot than what we have been,” he added.

Hershey expressed concerns over meeting heightened customer demand last Halloween — particularly for Reese’s — due to capacity limitations. But things are now looking up amid its supply chain investments. Chairman and CEO Michele Buck said in April that Hershey anticipates supply constraints will be behind it by this Halloween, aided by an anticipated 5% increase in production capacity this year. That jump includes the installation and start-up of three new Reese’s lines and a Hershey line. “The recovery that we anticipate is really driven by the increasing investments that we’ve continued to make over the past several years in capacity,” Buck said. Adding new lines isn’t the only way Hershey has unlocked additional production muscle. The company uses advanced analytics and AI to help find “hidden capacity,” Will Bonifant, VP of Hershey’s U.S. and Canada supply chain, said in an investor day presentation in March.

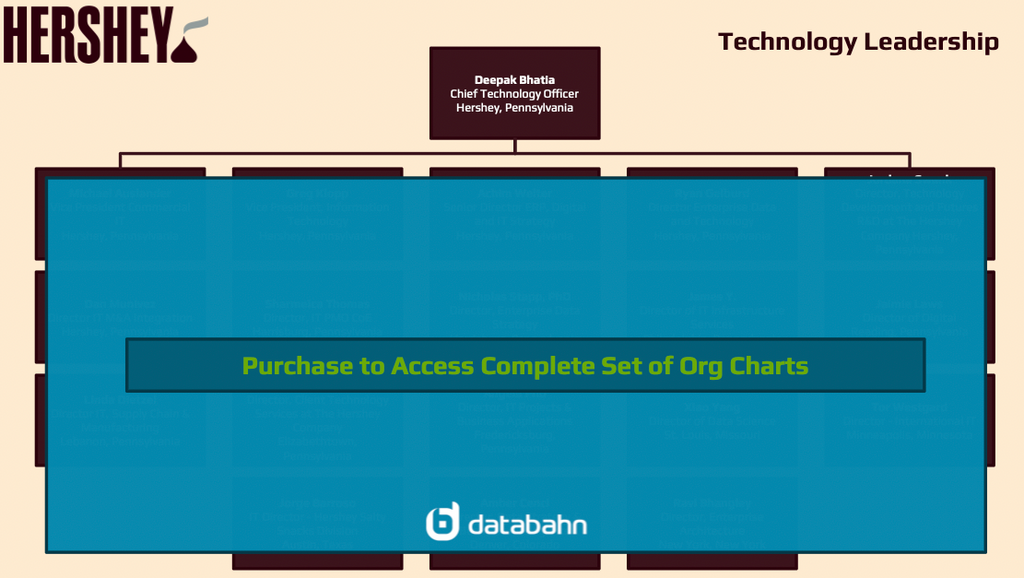

Hershey names Deepak Bhatia as its first ever chief technology officer

Sept 2023

Hershey’s global tech strategy is set to be directed by Deepak Bhatia, who has been appointed as its first chief technology officer, who has also been named on its Executive Committee, reports Neill Barston. As the company explained, he will lead on deploying digital capabilities that are innovative, flexible and prepared to meet the changing needs of its consumers, retail partners and employees. Formerly the Vice President of Supply Chain Optimisation Technologies at Amazon, Bhatia brings deep expertise in developing cutting-edge automated systems, supply chain planning, optimization and simulation, artificial intelligence and predictive analytics. He holds a M.S. in Management Science and Engineering from Stanford University and an M.S. in Aeronautics and Astronautics Engineering from Purdue University. He resides in Seattle, Washington, with his wife, Preeti, and sons, Daksh and Saarthak.

“We are investing in our people and digital capabilities to strengthen our infrastructure and scale across our growing supply chain and business units,” said Michele Buck, The Hershey Company President and Chief Executive Officer. “As we continue to double down in this area, Deepak has the expertise needed to successfully lead our technology strategy leveraging end-to-end data, analytics and automation to elevate our employee experience, create commercial value and advance our leading snacking powerhouse vision.” “I am honored and humbled to be joining Hershey, a company with an incredible legacy and culture,” shared Bhatia. “We are experiencing unprecedented technological innovation, and I am thrilled to spearhead the development and execution of a technology-driven transformation that will meet and exceed the evolving needs of our consumers and customers. I look forward to shaping a future of innovation and excellence.”

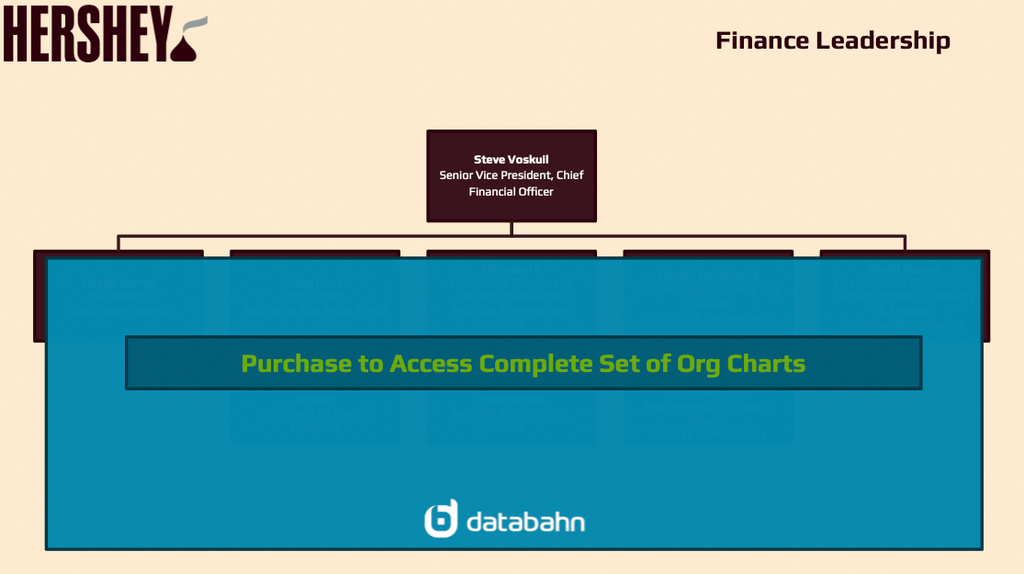

Hershey’s ERP upgrade to stretch into 2024

Feb 2023

The Hershey Company is investing heavily in its digital infrastructure, with execution underway of a new enterprise wide ERP system. The company expects capital expenditures of approximately $800 million to $900 million in 2023, which includes the ERP system implementation and expanded core confection capacity. Michele Buck, CEO and chairman of Hershey, expects the ERP project to continue into 2024, she said, speaking on last week’s Q4 2022 earnings call for the period ending Dec. 31 Hershey’s unallocated corporate expense in Q4 was $205 million, a 22.7% increase from $167 million last year during the same time period. The company tied the increase to higher technology costs related to the new ERP and digital infrastructure upgrades.

In mid-2018, Hershey added two ERP modules as part of a multiyear implementation. Aspects of the project were put on pause during the pandemic, shifting the timeline of the project. The ERP deployment has led to expected rises in capital expenditures and unallocated corporate expenses since the start. In the company’s Q4 2018 earnings call, Hershey expected capital expenditures to total around $330 million to $350 million. “Capacity expansion plus the ERP investments that will eventually drop out are the two kind of biggest components of the CapEx right now,” Buck said.