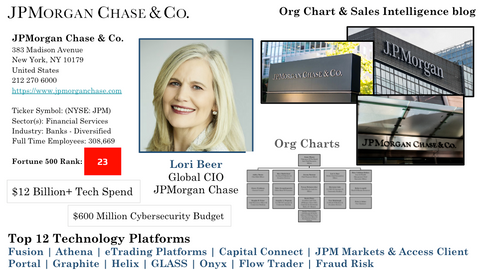

JPMorgan Chase Org Chart & Sales Intelligence blog

What are some of the highlights from the JPMorgan Chase Org Chart blog?

-

JPMC is investing more than $12 Billion USD on Technology

-

There is a $600 Million USD Cybersecurity budget

-

Cybersecurity is a non-negotiable priority across 4 business segments

-

Top 10 Technology Platforms at JPMC including Fusion, Athena Graphite, HELIX and GLASS

-

There are more than 300 Artificial Intelligence Use Cases

-

Chase.com is run fully on AWS

-

JPMC might be the first to release a ChatGPT-like product directly to its customers

-

Legal expenses are $1.3 Billion USD (ytd)

-

A top operational priority is to focus & invest in Customer Experience & Innovation

-

JPMC is procuring more efficient servers for its data centers to meet aggressive ESG goals

Scroll through the Google Slides presentation...

Having trouble viewing the Google Slides presentation?

Please download the PDF version to your desktop

![]()

JPMorgan Chase Org Charts

Top Technology Platforms at JPMG

1. Fusion. A cloud-native data platform to provide integrated solutions across the investment lifecycle. Using a modern data catalog and APIs, clients can seamlessly access JPMorgan's internal and third-party data. Fusion provides data management, reporting and analytics solutions across the investment lifecycle.

2. Athena. Athena is the JPMorgan platform providing cross-asset risk, pricing and trade management solutions to clients. It completes billions of risk calculations daily, and has achieved a 30% reduction in risk calculation times and a ~80% reduction in calculation cost per hour. Athena has moved to AWS which allows it to scale servers on demand.

3. eTrading platforms. The etrading platform helps clients with electronic execution. Low touch cash equities trading revenues have grown at a CAGR of 12% since 2017. The bank is improving its algorithms with structured datasets.

4.The Capital Connect platform: connect clients, founders and investors for private equity placements

5. Client portals like J.P. Morgan Markets and Access: seamless cash management, research, execution and pricing solutions

6. Graphite. A global real time payments system. JPMorgan has 5.5k engineers working on payments, plus 60+ fintech partnerships embedded in its solutions.

7. Helix. An API-based Merchant Acquiring platform to focus on unified APIs and cloud enablement.

8. GLASS. A platform to provide liquidity and account services such as wallet, virtual accounts, sweeps and pooling

9. Onyx by J.P. Morgan. The blockchain business unit, building innovative platforms like Liink, JPM Coin and Onyx Digital Assets. Onyx Digital Assets is JPMorgan's network for value and assets exchange.

10. Flow Trader. JPMorgan's system for utilizing AI to deliver faster quotes to clients.

11. Fraud Risk Modelling. JPMorgan is using AI to identify fraudulent transactions with AI to reduce losses. It's also leveraging AI/ML to improve operational processes across KYC, reconciliation, fraud and settlements.

This $12 Billion Tech Investment Could Disrupt Banking

JPMorgan Chase invests $12 billion per year on technology. Here’s why.

There are two kinds of corporations emerging from today’s technology revolution: the disrupted and the disruptor. JPMorgan Chase is in the midst of a once-in-a-generation transformation into the latter.

Silicon Valley may dominate the headlines, but it isn’t the only player in the emerging technology game. Being large and well established can be a burden for many companies, especially in industries swarming with nimble tech startups. But in the world of financial technology, it’s a blessing. Because developing cutting-edge technology is one thing; building a critical mass of loyal customers, and enough scale to fine-tune best-in-class products is quite another.

JPMorgan Chase is already there, with more than 60 million retail customers whose preferences help the company drive innovation and accelerate transformation.

"We have a tremendous amount of opportunity here," says Larry Feinsmith, Managing Director and Head of Global Tech Strategy, Innovation & Partnerships at JPMorgan Chase. "While other tech companies have a narrower scope of things they do very well, what differentiates JPMorgan Chase is our ability to invest $12 billion dollars in a broad number of technologies simultaneously. Our size and scale are simply unparalleled."

Digital Transformation

"We've always been a data driven company," said Larry Feinsmith, Managing Director and Head of Technology Strategy, Innovation, & Partnerships at JPMorgan Chase. Feinsmith, speaking with Databricks CEO Ali Ghodsi during a keynote at the company’s Data + AI Summit, said JPMorgan Chase has been continually investing in data, AI, business intelligence tools and dashboards. Indeed, JPMorgan Chase said it will spend $15.3 billion on technology investments in 2023. JPMorgan Chase's technology budget has grown at a 7% compound annual growth rate over the last four years.

Feinsmith said the bank's AI/ML strategy is one of the big reasons JPMorgan Chase migrated to the public cloud. "If you look at our size and scale, the only way to deploy at scale is to do it through platforms," said Feinsmith. "Everyone has an opinion on data platforms, but you can efficiently move the data once and manage. Once you start moving data around it's highly inefficient and breaks the lineage."

JPMorgan Chase, a customer of Databricks, Snowflake and MongoDB, has multiple platforms, according to Feinsmith. It has an internal platform, JADE (JPMorgan Chase Advanced Data Ecosystem) for moving and managing data and one called Infinite AI for data scientists. "Equally as important as the data is the capabilities that surround that data," said Feinsmith, adding that data discovery, data lineage, governance, compliance and model lifecycle are critical.

Chief Information Officer Lori Beer

“I feel my my number one job is to make sure we're delivering for our customers clients and communities across the globe and when you think about that very clearly we try to ensure that the 15.3 billion we invest in technology to really create the products and services we deliver and that covers a wide range of making sure we move our 10 trillion dollars a day across the globe to delivering the the leading industry Chase mobile app to really everything from protecting our customers and clients through cyber security and so we have 57,000 employees in Tech that really help support and drive not only cyber security building technology products and services and also delivering those last mile client and customer experiences as well.”

“We've been very much focused on a hybrid multi-cloud strategy and certainly with our size and scale and investment we need to be multi-provider versus defining for this specific workload where are we going to run it and leverage multiple public Cloud providers. The hybrid piece is important for us as part of our transition but also long term we have critical infrastructure for the US and so making sure we're very disciplined about what we run and where we run it and and that process is incredibly important too. A lot of people focus on their Cloud Journey around the new development which is important. We run chase.com fully on AWS for example, but the harder stuff is the applications that have run your business for many years and that you have to modernize and so while we have been opportunistic at looking at where we run those types of workloads that can scale up and quickly scale down and there's some cost leverage for us, the focus has been a little bit more on innovation. We have 57,000 technologists and 43,000 Engineers, so we try to be very disciplined about Runway leveraged SAS when we leverage third-party products what we need to build what we need.”

“We modernize the digital channels first because speed really matters as does driving new features and capabilities. now we're working addressing the core of some of our banking platforms. As we're releasing new features we're releasing them on the new architecture and we'll be very disciplined over time in terms of how we can drive that modernization in the right modular array versus the historic way of obviously doing a big bang sort of migration and so that's sort of how we started with our Cloud Journey. We've gotten some great wins in particular areas and now we're really talking about the modernization of some of our underlying core banking platforms.”

JPMorgan cloud migration will support more AI use cases

The shift comes as investors chafed at what one described on the company’s most recent earnings call as “the third year in a row of about $5 billion of expense growth” with a technology shift behind much of that growth. JPMorgan spent some $14 billion on technology in 2022 (run the bank expenses accounting for $7.4 billion), telling analysts on a frank earnings call that “if we don’t… we’ll be clunky and inefficient and hamstrung in the future when we’re trying to compete”. That will include getting card payments off mainframes, investing in multicloud-powered applications running as microservices and billions on brand new data centres, he added. The ongoing JPMorgan cloud migration will be critical to deploying more AI, Dimon said.

"Artificial intelligence (AI) is an extraordinary and groundbreaking technology. AI and the raw material that feeds it, data, will be critical to our company’s future success — the importance of implementing new technologies simply cannot be overstated. We already have more than 300 AI use cases in production today for risk, prospecting, marketing, customer experience and fraud prevention, and AI runs throughout our payments processing and money movement systems across the globe. AI has already added significant value to our company. For example, in the last few years, AI has helped us to significantly decrease risk in our retail business (by reducing fraud and illicit activity) and improve trading optimization and portfolio construction (by providing optimal execution strategies, automating forecasting and analytics, and improving client intelligence).

About databahn

Founded in 2015, databahn is an account intelligence company headquartered in Nashua, New Hampshire. The databahn research team specialize in providing comprehensive and up-to-date information on Fortune 1000 and Global 2000 companies. databahn offers a range of information services, including deep dive company profiles, financial insights, news updates, competitive analysis, and accurate contact information. databahn's account intelligence is meticulously curated, enabling businesses to make informed decisions, identify sales opportunities, and gain a competitive edge. With the focus on accuracy, completeness, and timeliness, databahn serves as a valuable resource for sales and marketing professionals and other industries that require reliable and actionable insights on large & complex enterprise companies.